The Underlying has Zero Intrinsic Value

Once upon a time, I worked on the floor of the Chicago Board of Trade, and I have a pretty solid background when it comes to reading the charts of stocks and commodities.

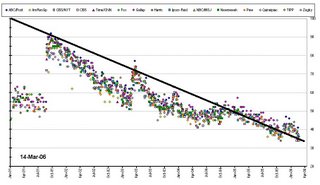

When trading Options contracts, there are two things that go into deciding a price. The first is the actual value of the stuff you are buying, and the second is a premium you pay depending on how much time you have left before you have to excercize the option or let it go.

This is a classic example of how a chart looks if the thing you are trading has no real value at all, and as it gets closer to expiration the price goes to zero.

The dots are Bush's polling numbers, from a chart by Stuart Thiel.

The black line is the % time Bush had left in office.

Right now we have about 35% of his time left, and he is at about 35% in the polls.

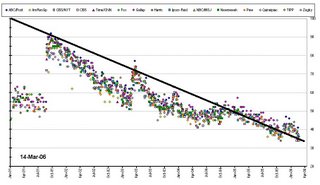

When trading Options contracts, there are two things that go into deciding a price. The first is the actual value of the stuff you are buying, and the second is a premium you pay depending on how much time you have left before you have to excercize the option or let it go.

This is a classic example of how a chart looks if the thing you are trading has no real value at all, and as it gets closer to expiration the price goes to zero.

The dots are Bush's polling numbers, from a chart by Stuart Thiel.

The black line is the % time Bush had left in office.

Right now we have about 35% of his time left, and he is at about 35% in the polls.

1 Comments:

You should post a campanion chart for the debt Bush is accumulating that we are going to have to pay off.

Post a Comment

<< Home